Export Tariffs on Chicken Farm Equipment in Kenya: A Guide for Chinese Manufacturers

Time : 2025-07-27

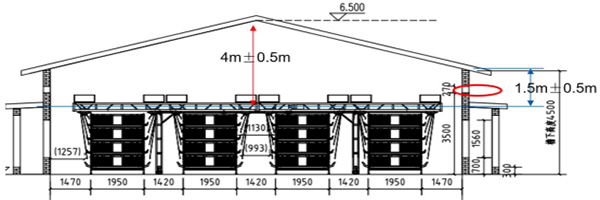

As a leading poultry equipment manufacturer from China, Livi Machinery understands the intricacies of exporting our high-quality products to various markets, including Kenya. One of the most significant factors that affect the export process is the imposition of tariffs on agricultural equipment, particularly chicken farm equipment. In this article, we will delve into the export tariffs on chicken farm equipment in Kenya, providing insights and practical advice for Chinese manufacturers like us.

Understanding Export Tariffs in Kenya

Export tariffs are taxes imposed on goods imported into a country. In the case of Kenya, these tariffs are designed to protect local industries and ensure that imported products comply with local standards. For chicken farm equipment, the tariffs can vary significantly, depending on the type of equipment and its intended use.

Types of Tariffs on Chicken Farm Equipment

- Standard Tariffs: These are general tariffs applied to most imported goods, which can range from 10% to 25% depending on the product category.

- Specific Tariffs: These are tariffs applied to specific products and can be higher than the standard rates. For chicken farm equipment, specific tariffs may be higher to promote the growth of the local poultry industry.

- Ad Valorem Tariffs: These tariffs are calculated as a percentage of the product’s value, which can lead to higher costs depending on the price of the equipment.

Impact of Tariffs on Chinese Manufacturers

For Chinese manufacturers like Livi Machinery, export tariffs can have a significant impact on pricing, competitiveness, and overall profitability. Higher tariffs mean higher costs for the end-user in Kenya, which can limit demand. Conversely, lower tariffs can make Chinese equipment more competitive and attract more Kenyan customers.

Strategies to Mitigate the Impact of Tariffs

- Understand Local Regulations: It’s crucial to have a thorough understanding of Kenya’s import regulations and tariffs. This knowledge can help in planning and pricing your products effectively.

- Explore Duty-Free Quotas: Some countries offer duty-free quotas for certain products. Exploring these options can help reduce the financial burden of tariffs.

- Local Partnerships: Forming partnerships with local distributors or agents can help navigate the local market and potentially reduce the impact of tariffs.

- Increase Local Production: Investing in local production facilities can help reduce the need for importing and, therefore, the impact of tariffs.

Key Considerations for Exporting Chicken Farm Equipment to Kenya

When exporting chicken farm equipment to Kenya, there are several factors to consider to ensure compliance and successful market entry:

1. Quality and Compliance

Kenya has stringent standards for agricultural equipment, including chicken farm equipment. Ensuring that your products meet these standards is essential to avoid delays or rejections at customs.

2. After-Sales Service

Having a reliable after-sales service network in Kenya is crucial. This includes technical support, maintenance, and spare parts availability, which can be critical for the long-term success of your products.

3. Cultural Considerations

Understanding the local business culture and customs in Kenya can help in building strong relationships with potential customers and partners.

Conclusion

Exporting chicken farm equipment to Kenya can be challenging due to the complexities of tariffs and local regulations. However, with careful planning and a thorough understanding of the market, Chinese manufacturers like Livi Machinery can successfully navigate these challenges and tap into the growing demand for high-quality poultry equipment in Kenya.

For more information on exporting chicken farm equipment to Kenya or to learn about our range of products, please visit our website at www.livimechanical.com.